Money

Common denominator

Today the world faces a global economic crisis, which appears to be the deepest economic crises humanity has ever seen. At the highest intergovernmental level conversations are increasingly being held about the necessity of international monetary system reform, for by many it is considered to be unable to meet the needs of today’s global economy. Yet, what should the new money be like, what purposes should they have and what functions should they perform?

Let’s try to take a different look at money. We will not use the word “currency” in the everyday sense, where it is equivalent to the concept of “money”, and will try to expand the meaning of the word, going deeper into its etymology. The English word “currency” takes its root from the Latin “currere”, which means “to flee”, “to rush”, “to leak”. In this broader sense, currency is nothing more than a tool for operating on different flows. In classical economics, it is the movement of goods and services, transfer of values from one set of goods and services to another. If we consider, in retrospect, any process of goods or values creation, and go deeper into its understanding to the level of physical processes, it becomes evident that any process of this kind is an overflow and conversion of energy.

All our vital activity in fact reduces to the transformation of one kind of energy to another, because according to the current position of science, any substance is nothing more than a state of energy waiting to be released. Thermal, mechanical, electrical, nuclear, metabolic, electromagnetic, vacuum energy, and so on, are all tools and products of our activities. After all, if taking thought, nothing else on earth carries such a fundamental and objective value as energy does! The conclusion suggests itself: energy and the unit of its quantitative expression – joule – is precisely the most correct, objective and fair content of the new currency. Since joule is an absolute measurement unit, binding money unit to a certain amount of energy will ensure the stability of the new currency, as well as transparency in the formation of its value.

Cradle-to-grave accounting

In a modern market economy, when we buy goods we often have no idea what exactly we are paying for, and why we are paying so much. How much has it cost the manufacturer to create this product, and how much was it worth to convince the consumer that purchasing this product is a “want” or even a “need”? And the main question is whether all of the society costs were included to the price of the product? What will shape the cost of goods, if money is clearly pegged to a unit of energy? The estimated components for the cost of each the goods are shown below in the Human and Resource Economic System cost formula:

Cost = Resource + Water + Production + Utilization + Compensation,

- Resource

- — the energy cost of restoring the spent renewable resource to the state of raw material;

- Water

- — the cost of water resources spent on the creation of the goods, expressed in units of energy by the interconnection through the so-called water-energy nexus; *

- Production

- — energy spent on creating the goods;

- Utilization

- — energy consumed for producing waste disposal and consuming the goods;

- Compensation

- — energy spent on compensating for adverse effects on the environment caused by production, consumption and waste disposal;

Thus, when we use the “spent energy” term for each cost calculation, we must consider not only the energy that is necessary to “attach” to the raw material for the product, but all the expended energy on the energy cost basis of primary energy resources and energy conversion efficiency. The accounting concepts here are close to those of “embodied energy” in Leontief’s input-output model, “virtual water” by John Alan and “cradle-to-grave” life cycle assessment (LCA) techniques which are already used by many governments worldwide and can be employed for cost calculation according to the proposed formula.

The Resources Institute

The Resource Institute — a global network of scientific institutes, departments, specialized institutions and individual professionals, united by common rules and working in accordance with the principle of Open Source or Commons-based peer production (where the creative energy of a great number of people is directed towards large significant projects without traditional hierarchical organizational structure) — will work upon a comprehensive interactive database that would display the energetic cost of any goods, services, technologies or other different subjects or processes for everybody. The database would be updated in real time to reflect the ongoing technological progress.

Triple Currency System

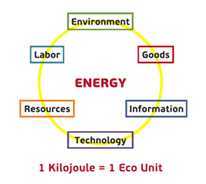

In the Human and Resource Economic System, people would use three separate currencies for different purposes. Within a single country there are three major different types of activities money are needed for: consumption, production and international trade. If three currencies are managed and treated separately, it will bring more sustainability to the whole financial system, and what is even more important, it will partly secure regular consumers from financial misbalances and speculative activities on the international currency market. The currency for consumption is called the Life Unit, which is backed by water and used only for the acquisition of consumable goods and labour.

The currency for production is called the Eco Unit, which is backed by energy and used for production purposes such as acquisition of raw materials, different machines and equipment or other production needs different from labour. The currency for international trade is called the World Wide Currency Unit, which represents itself a conversion coefficient to compare the prices of energetic currencies of different countries that is based on the following: the country’s share in the global amount of greenhouse gas emissions, the share in the global amount of water spent for production, the share in the global amount of consumed energy (the value of the currency is reduced by the percent of the share) and the coefficient of each average unit of energy consumed divided by the average amount of energy spent for its production according to the embodied energy input-output calculations (the value of the currency is multiplied by the coefficient).

Abolition of Cash

Nowadays, with the development of information and communications technology and electronic banking, an individual’s need for cash money is diminishing. Its existence, according to many, brings to the modern world more harm than convenience and profit. Cash makes it possibility for such adverse phenomena as corruption, drug trafficking, human trafficking, and illegal arms trade to exist, not to mention the illegal circulation of legal activities. The abolition of cash flow will make it easier to clearly conduct financial and production planning, as well as operational management of public finances. In addition, the need for colossal state spending for printing, collection, storage, accounting and disposal of cash money will abolish, as well as financial losses from counterfeiting and dealing with it.

Having a POS-terminal and a payment card integrated in his personal communicational device, each person will be able to easily make and receive payments as well as automatically obtain all the available information about the acquired goods and verify its authenticity if necessary. It also gives consumers the possibility to provide and inquire feedback within the global product and service database. The development of information technology suggests the possibility to give the consumer full information about products consumed without significant costs, as well as the ability of manufacturers to declare the cost to the consumer.

Abolition of Interest Rate

In the present-day world, due to the high degree of concentration and consolidation of capital in the hands of a very small proportion of the population (according to different sources 1% of the population owns 50% of all productive capital, and 2% of the population owns 80% of capital), the existence and availability of interest rate loans meets the aims of the traditional economy in establishing productivity increase, but not in any way appeals to such global human problems as health, education and protection of the environment. None of the traditional economic paradigms detects that the system of private property was originally designed for the diffusion of capital rather than for the concentration of ownership in a few hands.

. As it is known, the basic requirement of a free market concludes that it should not contain insurmountable barriers for entering it. In order to have competitive market efficiency, it should be open to everyone who wants to play by market rules, which involve voluntary participation, free exchange and respect for private property. However, most potential markets in any market economy of the present time are not really open to everyone. The current system of corporate finance in countries with developed market economies has led to the fact that effective participation in capital acquisition and corporation growth is closed for the majority of their populations. And, despite the fact that the traditional market theories are postulating the formal right to acquire equity for everyone, real rights are available only for existing owners of capital assets.

Unequal capital access capabilities of existing producer and consumer (which could potentially become a producer) are associated with the existing system of interest rate cost for capital, as well as with the existing system of debt defaults risk assessment and the existing collateral rules. Thereby, for an existing company with large operating assets, a major financial traffic and a well covered market share it is much easier to attract a bank credit (particularly in terms of providing collateral and in general in terms of risks of the business project) than for the average consumer, who when applying for a loan can only offer a hypothetical business idea and a pledge of his private property, which, even if available, can seldom ensure receiving the necessary sum for the business to start. By abolishing interest for loans purposing the non-consumer needs that can provide long-term productive efficiency increase and spreading productive capacity as well as eliminating strict collateral rules, we can balance the capital access capabilities for existing enterprises and ordinary people willing to start their own business and become capital owners.