Supply

Two Production Factors

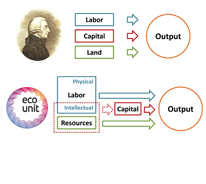

Let’s consider production factors as if there were neither money, nor economy, nor economical theory, and as if we lived in a primitive society. To produce any goods, we need raw materials (certain natural resource or combination of several of them) and labour, which is our own effort to transform available raw materials into a product. Our labour can be both physical and intellectual. While physical efforts are needed for the direct processing of raw materials, intellectual efforts are necessary to determine or improve the way of such processing.

A well grounded economist will claim immediately that the modern economic theory distinguishes capital and entrepreneurship, while fresh trends of the informational era add information (whether they are technology or banal exchange bulletin). But how fair is this statement? Any capital, whether it is a spade, a millstone, a machine or a car, is the product of human labour applied to a certain combination of natural resources. Any information is also the result of intellectual labour, as well as entrepreneurship, which is determined as the ability to combine different production factors, which is also intellectual activity! As we see from what is stated above there are only two sources of wealth: labour and natural resources.

Openness Principles

In a modern market economy when we buy goods we often have no idea what exactly we are paying for, and why we are paying so much. How much did it cost for the manufacturer to create this product, and how much was it worth to convince the consumer that purchasing this product is a need? And the main question is whether all of the society costs were included to the price of the product? As the experience of major corporations shows, it doesn’t matter what the quality of the goods is, but that the consumers consider it high-quality.

Although absurd from the standpoint of economy and inherently fraudulent in fact, components of the price concealment principle for many centuries have become axiomatic “pacto tacito” (tacit agreement) between all companies and to any and every market without exceptions. The principle of commercial confidentiality in the traditional economy, ostensibly designed to protect free competition, is more often used by large manufacturers either to hide their not quite fair industrial policy, or to conceal from the consumer the real cost of goods and the level of sellers profits. Usually the average consumer sees only an abstract value in the price list, which is expressed in a certain amount of monetary units with the mechanism of valuating, which the majority of the population has a fairly vague idea of.

Thanks to increase in state expenditures for informatisation together with compulsory implementation of maximum transparency principles for manufacturers and declaration of a full production cost chain in order to ensure the honesty of pricing and production policy, a consumer becomes not only sufficiently informed on the characteristics of goods consumed, but also more capable of making an adequate analysis of such information, which, of course, will contribute to the general increase in effective consumption. Full transition to cashless transactions, using the principle of maximum openness of the manufacturer and a maximum reduction of adverse marketing influence are the key factors in reaching the sustainable consumption.

Principle of Sustainable Economic Accounting

Nowadays, raw materials and fossil energy resources usually belong to those who bought from the government the right to exploit them. What is the price of this right? It is difficult to answer definitely – it varies depending on every separate case. But certainly the price almost never reflects the value of resources being exhausted by the renters, and by no means does it reflect the value of accompanied environmental degradation. The modern economic paradigm in most countries of the world very seldom considers the fact of the finiteness of mineral and fossil energy resources and the fragility of ecosystems.

Because ecosystem services are not fully “captured” in commercial markets or adequately quantified in terms comparable with economic services and manufactured capital, they are often given too little weight in policy decisions. Research in ecological economics has estimated the current economic value of 17 ecosystem services for 16 biomes, based on published studies and a few original calculations. For the entire biosphere, the value (most of which is outside the market) is estimated to be in the range of US $ 16–54 trillion per year, with an average of US $ 33 trillion per year. Because of the nature of the uncertainties, this must be considered a minimum estimate. Global gross national product total is around US $ 74 trillion per year.

When we talk about the overexploitation of such natural resources as clean air, fresh water and different ecosystems, we mean what economists use to call negative externalities. The contemporary economic approach usually sounds like “Internalize externalities and the problem is going to be solved”. This means create a market, define the property rights, assume that people act rationally and minimize the transaction costs. But how can one imagine for example the market of fresh air, not mentioning the weakness of the assumption about people acting rationally and a vague possibility in this particular case to minimize the transaction costs and define the property rights! This approach is hardly a sustainable one. The human and resource economic system offers a clear principle of sustainable economic accounting:

This principle is outlined in the Human and Resource Economic System cost formula mentioned above. It should be provided by using the input-output analyses further developed to describe ecosystem energy flows. Considering that any economic activity as the handling of energy flows, two opposite processes become obvious, notably, energy storage and energy wasting. Use of alternative energy sources, compulsory increase in useful lifetime of wealth by producers, restriction of marketing and advertisement tools, fixation of fair price of the resources and appearance of the ecological component of each wealth price will make it possible to form new principles for objective determination of economic efficiency, which will be based not on the volume of earned money, but on the quantity of accumulated, stored, transformed and wasted energy.